Kuwait Financial Centre “Markaz” recently released its Monthly Markets Review report for the month of October 2020. Markaz report stated that, most GCC equity markets ended the month in red as weak earnings and dim economic outlook pressured markets.

Kuwait markets were flat, with the Kuwait All Share index registering a minor loss of 0.04% in October. Kuwait All Share Index’s PE ratio was at 13.4 by the end of the month. Market liquidity in October as indicated by the average daily traded value has increased by 19% over previous month to USD 197million. Moody’s estimate Kuwait to be the most sensitive among GCC countries to the prolonged decline in oil prices caused by the COVID-19 pandemic, with oil and gas revenue shock of -29.2%. Central Bank of Kuwait has maintained discount rate at 1.5% and has lowered the repo rate and yields on term deposits, direct intervention instruments and public debt instruments by 0.125%. IMF has forecasted Kuwait’s GDP to contract by 8.1% in 2020, a steep revision from its earlier forecast of 1.1% contraction. Among Kuwait sectors, Industrials was the top gainer, rising 2.4%, while technology index saw the biggest decline, down 4.8% for the month. Among blue chips, Mobile Telecommunications (Zain) gained the most at 2.1%, while National Bank of Kuwait lost 2.9% for the month. National Bank of Kuwait has reported a 38% y-o-y drop in net profit for Q3 2020, hit by higher provisioning for bad debt and economic slowdown caused by the pandemic.

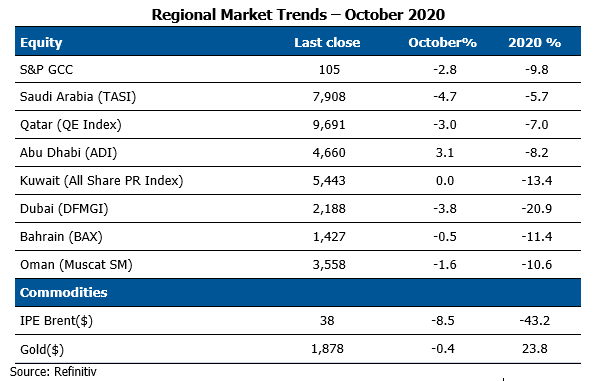

Regionally, the S&P GCC composite index lost 2.8%, with all markets ending the month in negative territory, except Abu Dhabi, which gained 3.1% for the month. Saudi Arabian equity market lost 4.7% in October followed by Dubai, which lost 3.8%. Saudi Arabia’s merchandise exports dropped by 36% during the first eight months of the year. S&P downgraded Oman for the second time this year to B+, citing weakening of its public sector finances. Oman raised USD 2 billion in its first international bond sale of the year. IMF expects GCC region’s GDP to contract by 6% in 2020 and to grow by 2.3% in 2021. Non-oil GDP is expected to contract by 5.7% this year mainly due to collapse of service sector caused by a decline in domestic and external demand. Oil GDP is expected to contract by 6.2% in 2020 on the back of production cuts based on OPEC+ agreements caused by sluggish oil demand.

Markaz report also stated that among the GCC blue chip companies, National Commercial Bank (Saudi Arabia) increased by 5.1% in October. The bank has reported a 24% y-o-y increase in net profit for Q3 2020 due to rise in net commission income and fall in impairment charges. It has also signed a binding merger agreement with Samba Financial Group. The merged bank, with assets worth USD 223billion, would be GCC’s third-biggest banking entity after Qatar National Bank and First Abu Dhabi Bank (UAE). Ezdan Holding (Qatar) lost 12.8% followed by Emirates NBD Bank (UAE), which decreased by 10.8% in October. Emirates NBD Bank’s net profit for Q3 2020 slumped by 69% y-o-y, as bad debt charges rose due to the COVID-19 crisis. The steeper drop was also partly due its higher earnings in Q3 2019 on the back of asset sale.

The performance of global equity markets was negative, with the MSCI World Index losing 3.1% in October. U.S. market (S&P 500) lost 2.8% in October amid rising COVID-19 cases and prolonged stimulus deadlock. The U.K (FTSE 100) markets lost 4.9% for the month. Lockdown restrictions were tightened during the month in U.K and broader Europe to handle increasing COVID-19 cases. Emerging markets increased by 2.0% for the month.

Oil prices closed at USD 37.5 per barrel at the end of October 2020, posting a monthly loss of 8.5%. While OPEC’s assurance that the worst is over for oil, supply disruptions in Norway and Gulf of Mexico, Russia’s openness to consider extend supply cuts for longer if required supported prices during the month, spike in COVID-19 cases in U.S and Europe, renewed lockdown restrictions in Europe and increase in Libyan oil exports pushed prices down towards month end. IMF expects oil prices in 2021 to be stagnant in the range of USD 40-50 per barrel.