Markaz records Total Revenue of KD 26.32 million in 2023, an increase of 40.0% y-o-y

.png?lang=en-US)

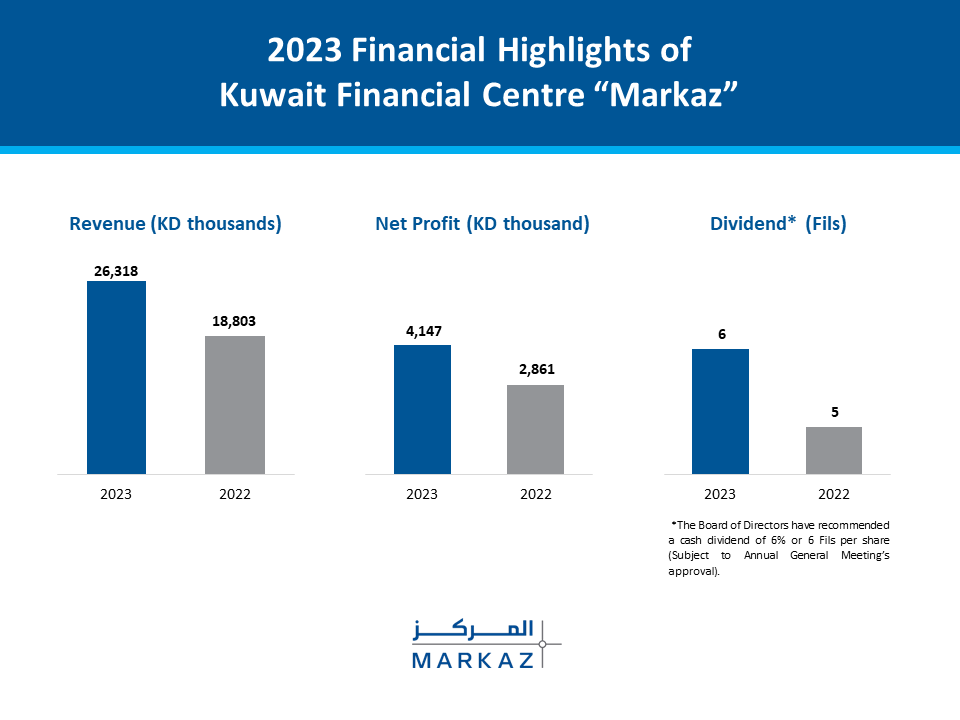

Kuwait Financial Centre “Markaz” (KSE: Markaz, Reuters: MARKZ.KW, Bloomberg: MARKAZ: KK) reported its financial results for 2023 with a Total Revenue of KD 26.32 million, as compared to KD 18.80 million in 2022, led by gain from the sale of international and GCC real estate investments. Net Profit attributable to shareholders was KD 4.15 million, compared to KD 2.86 million in 2022 and Earnings Per Share was 8 Fils for the year ended 31 December 2023.

Mr. Diraar Yusuf Alghanim, Chairman stated: “During the year 2023, the GCC Economies witnessed huge development driven by the momentum in Saudi Arabia and the UAE. The MSCI GCC index increased by 7.7% in 2023. In the context of the national economy, the IMF anticipates 2.9% real GDP growth in 2024, underpinned by attractive oil market dynamics. Inflation is expected to remain relatively subdued.

Throughout the year, the global economy encountered significant challenges due to the effects of escalating inflation, rising interest rates and the prolonged war in Ukraine. The outbreak of war in the Middle East, and the cooling of the US-China relationship, further intensified supply chain constraints, and global GDP growth in 2023 declined to 3.1% compared to the previous year (World Economic Outlook January 2024 edition). On the other hand, the asset management sector is experiencing a data-driven transformation led by artificial intelligence. By generating superior insights, artificial intelligence supports decision-making, constructing investment portfolios, and enhancing risk management. This opens doors to a new approach to alpha generation and a future where asset management is dependent on leveraging the power of data.”

Mr. Ali H. Khalil, CEO, stated: “Markaz’s Asset Management fees for 2023 were KD 7.17 million as compared to KD 10.60 million for the previous year. Investment Banking and Advisory fees for 2023 were KD 0.84 million as compared to KD 0.67 million for 2022, an increase of 25.4%. GCC real estate markets showed improvement, with a backdrop of higher oil prices and economic growth initiatives across the region, resulting in firmer rental and occupancy rates. As a result, our Net Rental Income was KD 2.19 million. From an Asset Management perspective, Markaz Assets Under Management (AUM) increased by 5.03% to reach KD 1.21 billion as of December 31, 2023.

Although market concerns are likely to continue well into 2024, the Markaz approach to risk adjusted investment decision making will well serve its corporate, institutional and high-net-worth clients. A deep understanding of our client’s financial objectives has underpinned Markaz’s success over the last 50 years, especially during uncertain market conditions. As M&A favourable conditions return, the Investment Banking team is well positioned to advise on those transactions and also complex restructurings, listings, and IPOs. The real estate sector is expected to offer promising opportunities due to regional demographic and economic reforms, benefiting our real estate division. Markaz's adaptable business strategy and dedicated focus on client goals position us to capitalize on emerging opportunities in asset management and investment banking.”

New financial services, funds, awards and other key highlights recorded in 2023

Markaz marked the end of 2023 on a high note having recorded a series of achievements over the year. These successes included the launch of new investment tools and financial services, new and renewed business deals, employee well-being initiatives, and ten prominent award receptions. Alongside new products announced, Markaz reiterated its commitment to local communities through its corporate social responsibility (CSR) campaigns, partnerships and sponsorship programs.

Reflecting on the year, Ali H. Khalil, Chief Executive Officer of Markaz, said: “At Markaz, we take each year as a new opportunity to surpass our previous achievements, and ensure that we take our talent, dedication, and operations to the next level. Our solid strategy has always paved the way for Markaz to take on new challenges and endeavors and watch them materialize over the course of the year. Our clients and stakeholders’ interests are at the core of our operations and with more than 50 years of expertise in the investment community, we pride ourselves on our market knowledge, research-based framework and more so, our people behind every success we can record. 2023 has been a good year for Markaz, with every year representing yet another steppingstone for what is to come, and we look forward to what 2024 will bring”.

Mr. Abdullatif W. Al-Nusif, Managing Director of Wealth Management and Business Development at Markaz, also commented on the achievements recorded throughout 2023. He said: “We are proud to have achieved another successful year with the introduction of new research-driven investment solutions, tailored to address our clients’ investment needs and goals. In 2023, Markaz exemplified its commitment to Kuwait’s financial market as we introduced landmark services, with the aim of reinforcing our mission to help generate and retain wealth for our clients, accompanied with a myriad of other achievements that have made the year indeed one for the books.”

Impact through Innovation

Underlining its dedication to proactively delivering innovative products and solutions to the Kuwait market, Markaz officially launched its GCC Momentum Fund during 2023. The passive fund follows a momentum methodology, providing investors with an opportunity to invest in top performing GCC stocks at a lower expense ratio than other GCC equities funds. Moreover, in an effort to play an impactful role in the development of the Kuwaiti capital market, Markaz became the first company to launch Securities Lending and Borrowing (SLB) services in Kuwait. The company hosted an introductory seminar in October at Boursa Kuwait’s offices on the central lending and borrowing service as well as the advantages and risks associated with short-selling activities. The introduction of the new services aligns with Markaz’s track record of providing traders with a wide spectrum of innovative, wealth-creation tools including Mumtaz ‘the first domestic mutual fund’, Forsa Financial Fund ‘the first and only options market maker in the GCC in 2005, Idikhar ‘the first money market fund in Kuwait’, and MREF ‘the first real estate investment fund in Kuwait’.

In the investment banking spectrum, Markaz and the Commercial Bank of Kuwait (Al-Tijari) jointly announced the successful issuance of bonds with a nominal value of KWD 50 million and a tenure period of 10 years, callable after 5 years. Markaz, as the lead manager and subscription agent, was successful in issuing bonds for KD 50 million under the subordinated Tier 2 capital bonds program. The first-of-its-kind bond issuance denominated in Kuwaiti dinar signifies a milestone with both institutions and was fully subscribed through private placement to qualified investors. Another notable achievement during the period was the completion of the first KD-denominated convertible bond issuance for Sultan Center Food Products Company K.S.C.P., where Markaz served as the structuring advisor and lead manager , which had a nominal value of KD 9.65 million and a 10-year term. Markaz continues to support local companies from various sectors in issuing bonds and sukuk to secure the necessary financing for their operations. Al-Ahli Bank of Kuwait (ABK) has successfully issued KD 50 million worth of bonds in cooperation with Markaz as one of the joint lead managers. During 2023, Markaz was able to work on numerous mandates throughout the year predominantly with new clients. Those mandates involved work in valuations, feasibility studies, mergers, sell-side M&A, and financial restructurings amongst others.

Markaz successfully exited one multifamily project and partially exited an industrial project, achieving a net IRR of 10.0% and 18.0%, respectively, in the US. In Europe, we achieved a net IRR of 11.9% on the sales of our Industrial project in the Netherlands. Furthermore, Markaz completed the exit of Dubai property “Vezul” Abu Dhabi Property “Parkside”, and the Riyadh complex “Rihab Pearl”. These milestones demonstrate Markaz’s commitment to offering diversified global investment opportunities and delivering favorable returns for its clients.

Promoting Employee Wellness

Reinforcing its people-first culture throughout 2023, Markaz successfully hosted a series of events aimed at promoting wellness among its employees. In addition, 2023 was a landmark year with the strategic relocation of its headquarters to Burj Alshaya. This move reflects Markaz's commitment to continuous growth and adaptation in the evolving financial services industry and signifies its dedication to creating a dynamic and robust working environment for its employees. The new headquarters, symbolizing Markaz's growth journey and proactive approach to change, enhanced integration among departments, increased efficiency, thereby fostering a nurturing environment that elevates employee well-being. It also aligns with Markaz's vision of providing an environment conducive to innovation and productivity reaffirming its readiness for the next phase of its journey.

Giving Back to Society

Since its inception, Markaz has firmly believed in making a difference by giving back to society, guided by its CSR strategy’s three pillars: building human capacity, aligning the business environment with sustainable development principles, and promoting good governance in the business environment.

Aligning with the building human capacity pillar of its CSR strategy, Markaz extended its partnerships with a number of local organizations and non-profits. The company continued its support towards LOYAC, AC Milan Soccer School in Kuwait, Kuwait Association for the Care of Children in Hospital (KACCH), Bayt Abdullah Children’s Hospice (BACCH), and the Children's Cancer Center of Lebanon (CCCL), as well as the “Watheefti” fair and the project exhibition organized by engineering students at the Australian University of Kuwait (AUK). Markaz also renewed its contribution to the Kuwait Red Crescent Society (KRCS) and the United Nations High Commissioner for Refugees’ humanitarian missions.

The year 2023 also witnessed Markaz participating as a Gold Sponsor of the Golfe Vision 2023 conference, a new platform aimed at fostering greater business collaboration between France and countries within the Gulf Cooperation Council (GCC). Similarly, Markaz served as the Gold Sponsor of the 2nd edition of the Kuwait Public-Private Partnership Conference, and as a ‘Strategic Partner’ in the 2nd edition of the MoneyTech Summit, organized by Al-Jarida.

In line with Markaz’s efforts towards empowering investors to make informed, responsible decisions, Markaz held its annual seminar titled ‘‘Markaz 2024 Outlook: Investment Trends and Opportunities’, in the presence of a group of experts from Markaz, along with local and international prominent institutions. The seminar aimed at sharing insights on emerging investment opportunities regionally as well as globally, in equities, real estate and fixed income, and investment banking services including IPOs and advisory and Mergers and Acquisitions.

The Markaz Graduate Development Program (MGDP), which first launched in 2017, continued to provide young Kuwaiti graduates with hands-on training to equip them with the skillset necessary to excel in their respective financial sector careers. The program enabled the training of 57 graduates with 42% of them being offered a position at Markaz upon completion.

In line with its commitment to responsible investment, Markaz has become the first Kuwaiti financial institution to be a signatory to the United Nations-supported Principles for Responsible Investment (PRI). By joining this leading international network of institutional investors, the financial institution reinforces its dedication to integrating environmental, social, and governance (ESG) considerations into its investment decisions and practices.

Awards and Recognitions

Markaz ended 2023 with 10 prestigious new awards including ‘The Best Private Bank in Kuwait’; from Global Finance and ‘The Best Private Bank or Wealth Manager Servicing the State of Kuwait‘ from Wealth Briefing. Markaz was also recognized by Euromoney as “Middle East's Best for Investment Research” and “Best Domestic Private Bank in Kuwait”, in addition to being ranked as a Market Leader in investment banking, Highly Regarded in CSR and digital solutions, and Notable in Diversity and Inclusion. As a leading investment solutions provider, Markaz was also recognized with two major awards from MEED including ‘MENA Investment Bank of the Year’ and ‘Excellence in Real Estate Investment’.

Embracing 2024 with an Optimistic Outlook

Markaz looks forward to 2024 with a highly optimistic vision to continue delivering leading investment banking, wealth management, asset management and research to its stakeholders. Innovation and buoyant growth strategy will remain at the heart of its operations where the team of experts will relentlessly persevere to design, deploy, and manage effective solutions that would drive growth, development, and expansion. Markaz will continue its journey of building successes while focusing on a customer-centric approach and upholding its promise to deliver on clients’ objectives and further cement its position as the trusted partner in wealth creation in the Middle East and beyond.