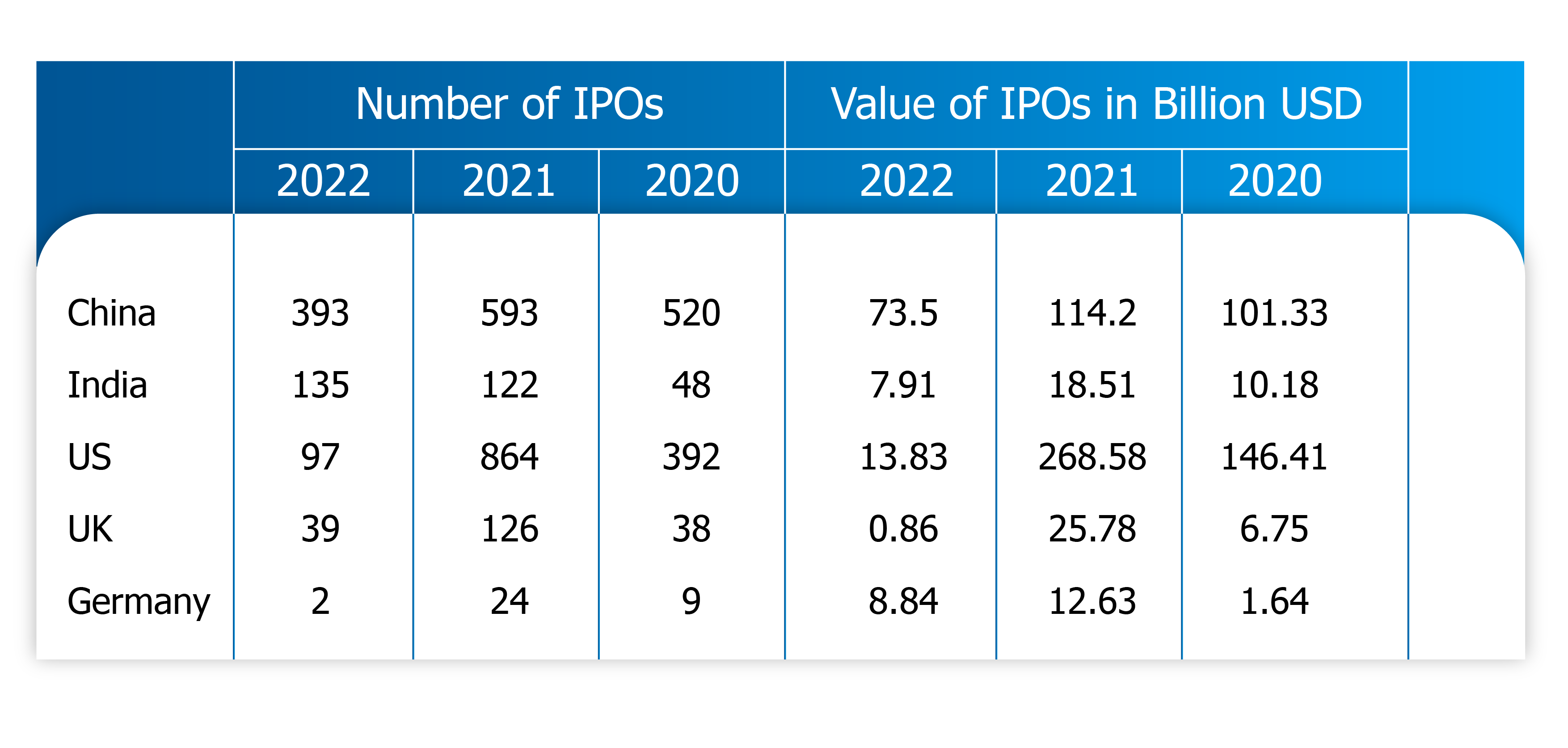

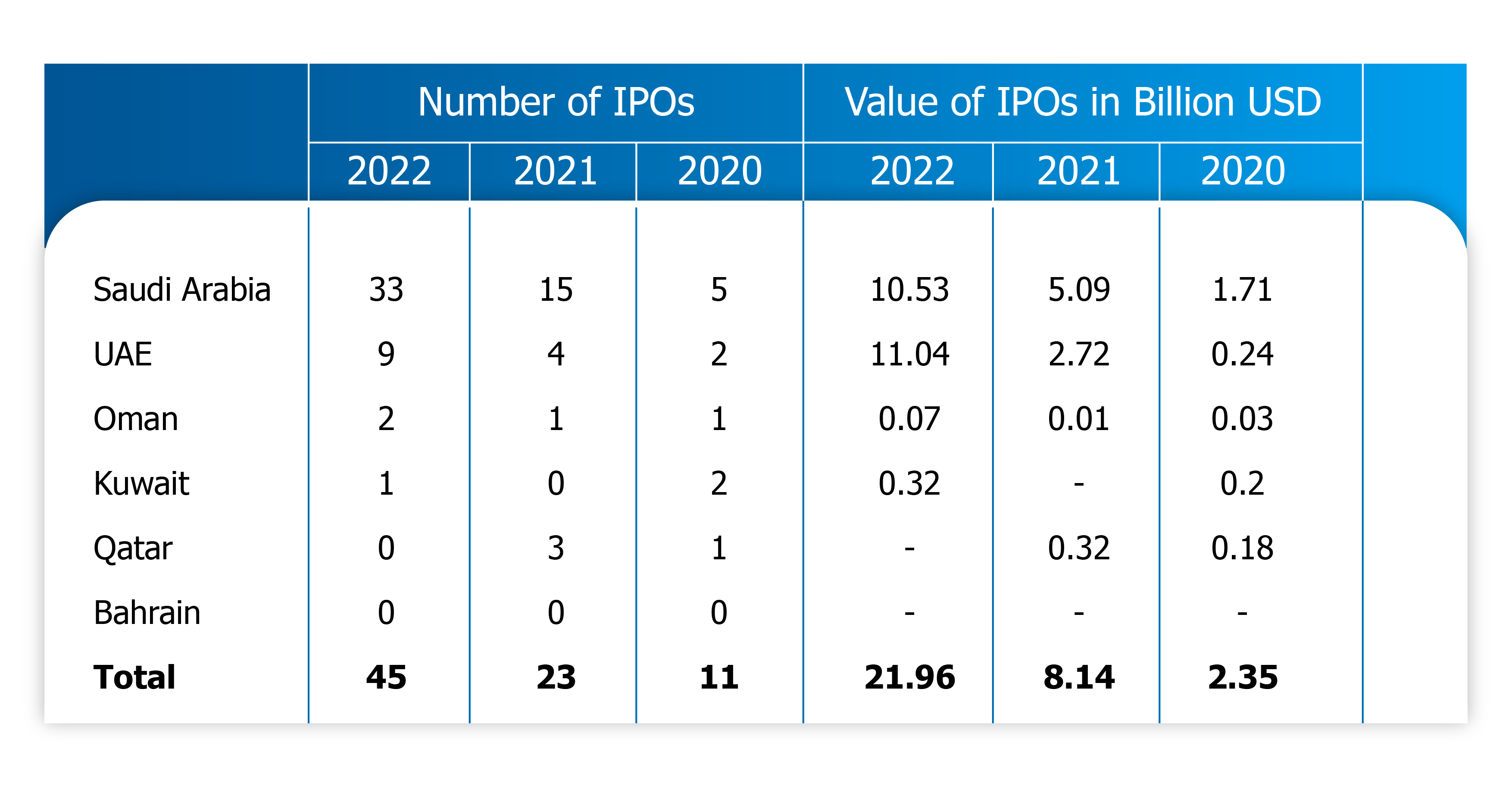

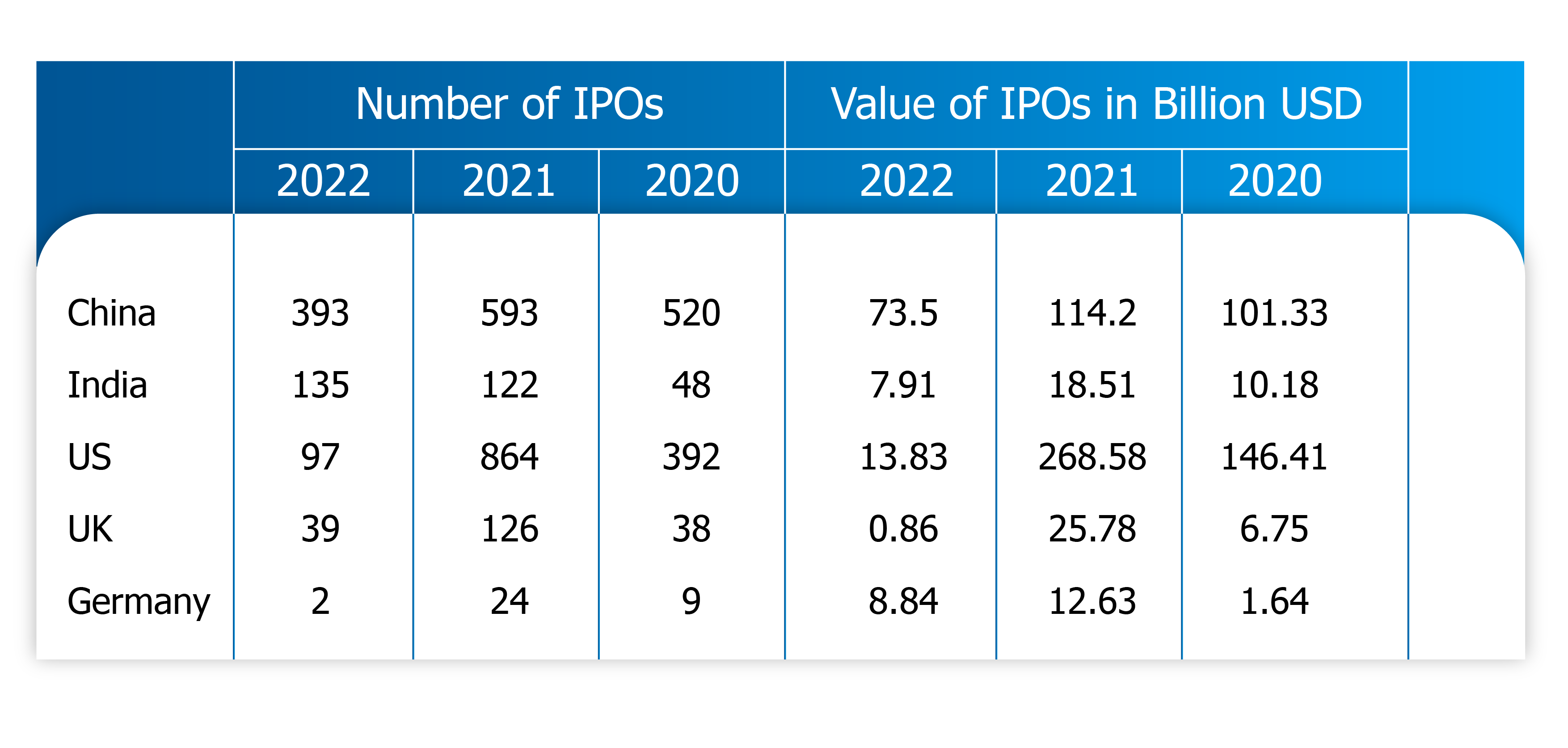

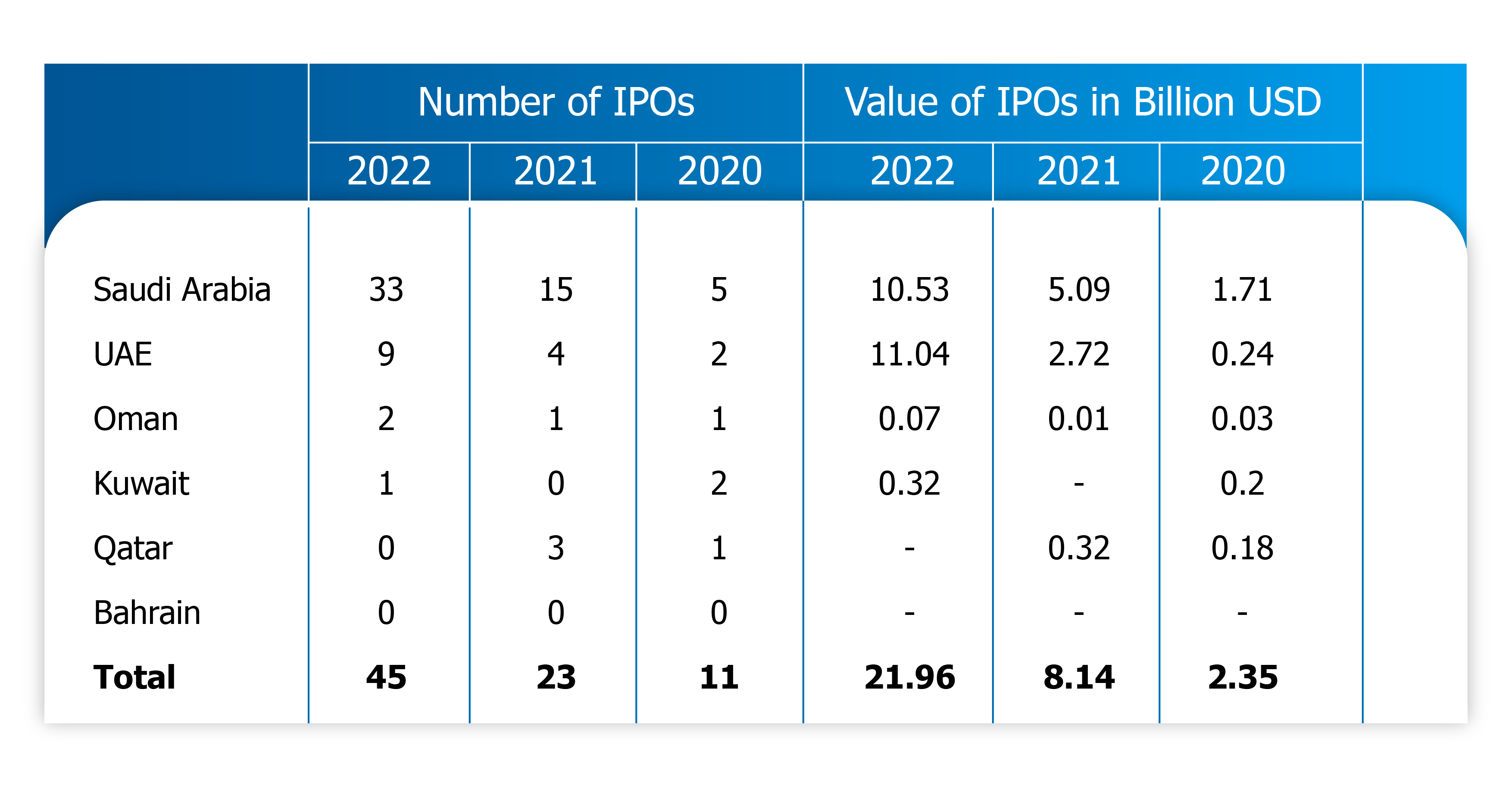

Activity in the Global IPO markets were subdued in 2022, after scaling multi-year highs in 2021. Volatility in global markets, particularly in US and Europe have made market conditions unfavorable for IPOs in 2022. Headwinds such as high inflation, geopolitical tensions in Russia and Ukraine and aggressive central bank tightening were some of the factors that led to heightened volatility. On the flipside, GCC IPOs witnessed a sharp uptick in 2022 compared to the previous year with higher oil prices, comparatively lower inflation and stronger economic growth providing a positive platform for companies to list in the domestic exchanges. GCC region accounted for about 23% of the USD 179.5 billion raised in all IPOs worldwide in 2022. This is a major rise compared to previous years, where in 2021 the region accounted for only 2% of the global IPO proceeds.

Source- Refinitiv (includes dual listing)Exhibit- IPOs of major markets in comparison with GCC markets

Source- Refinitiv (includes dual listing)Exhibit- IPOs of major markets in comparison with GCC markets

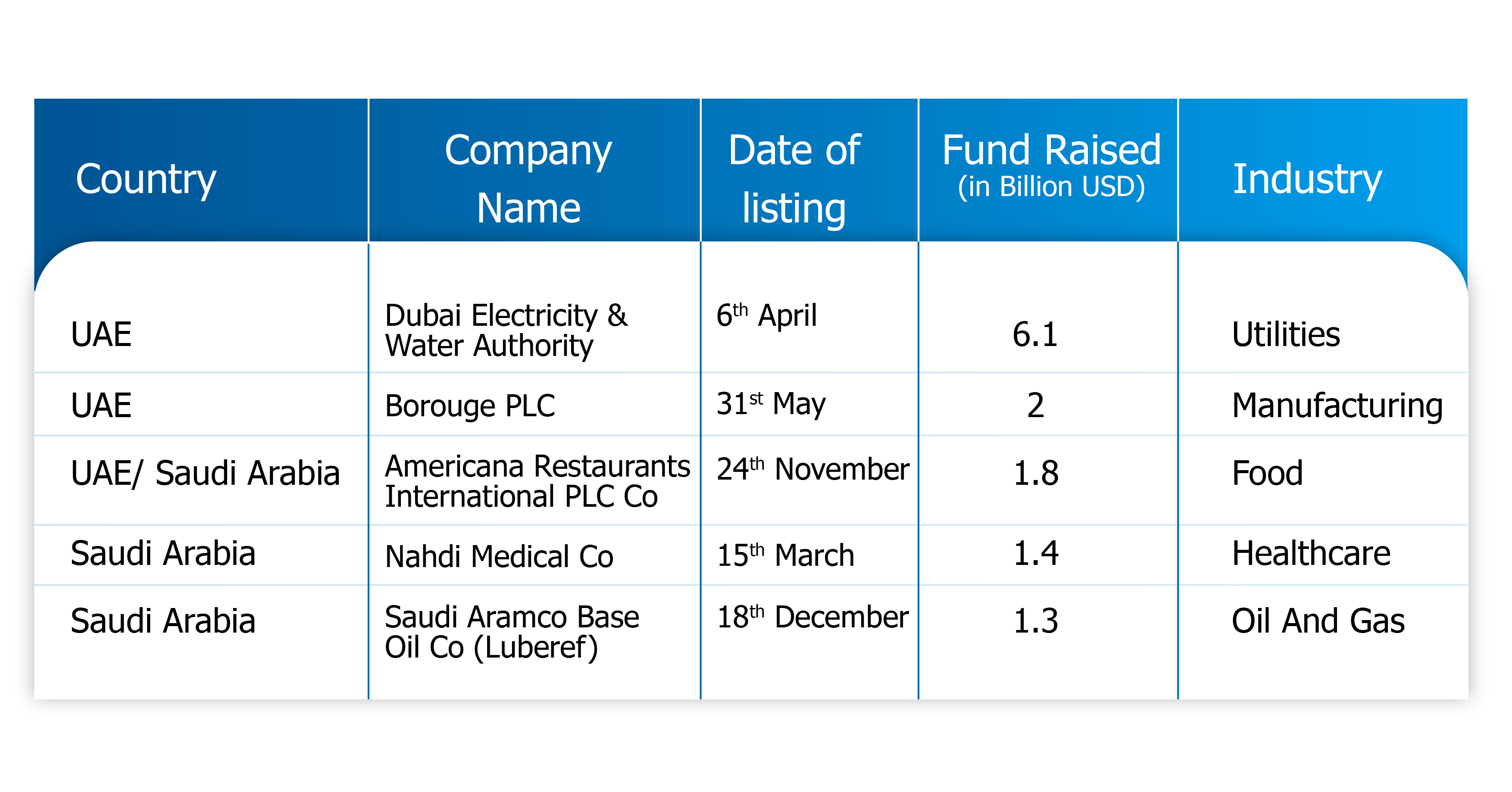

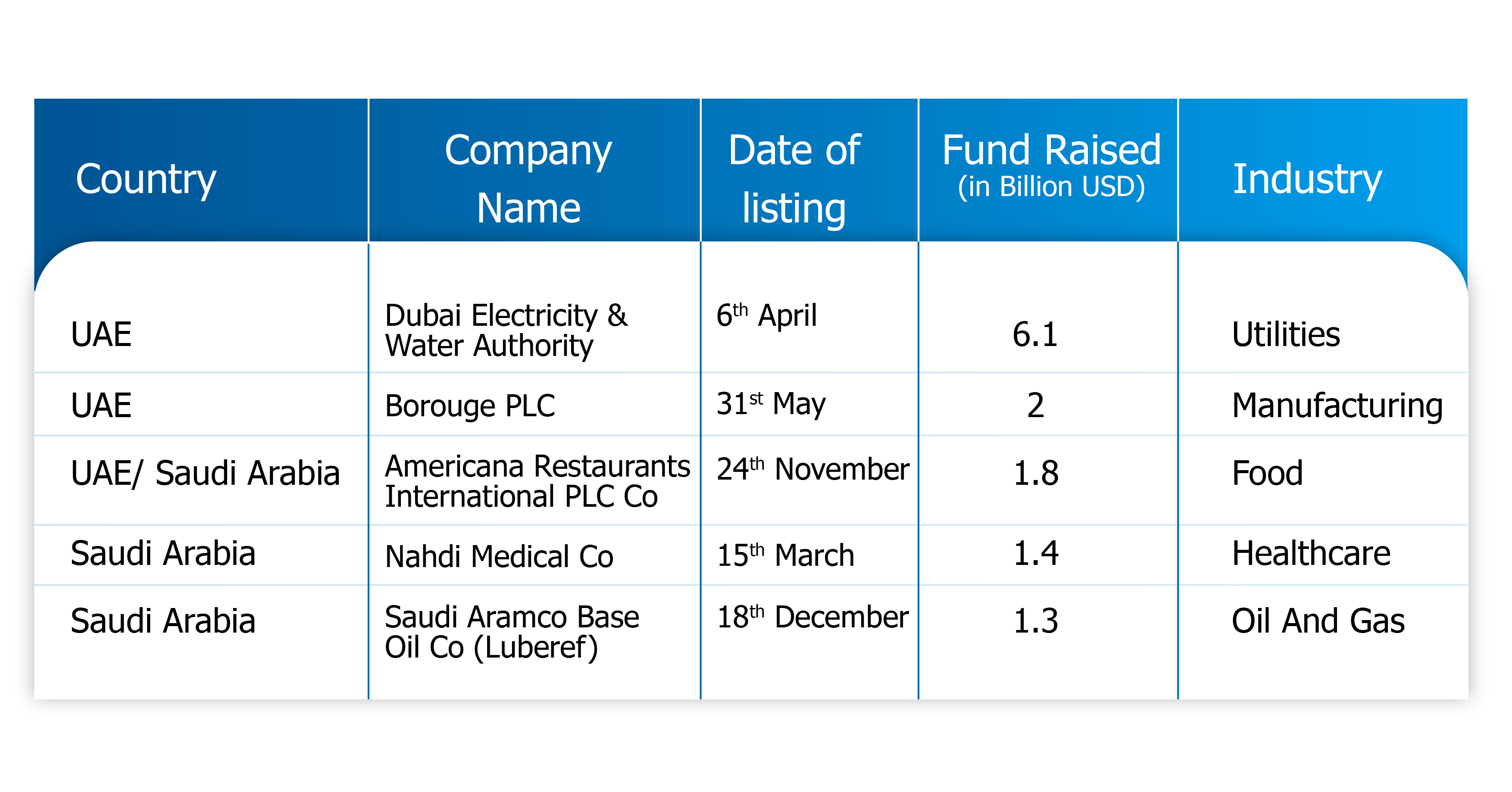

KSA and UAE dominated the listings in the GCC. State owned entity Dubai Electricity and Water Authority (DEWA) was the largest listing in terms of value in 2022 raising USD 6.1 billion. DEWA, Borouge and Luberef were the 3 state owned entities in the top 5 listings indicating UAE government entities initiatives to go public.

Exhibit- Top 5 GCC IPOs in 2022, By Value

Source- Refinitiv

Dominance of KSA and UAE

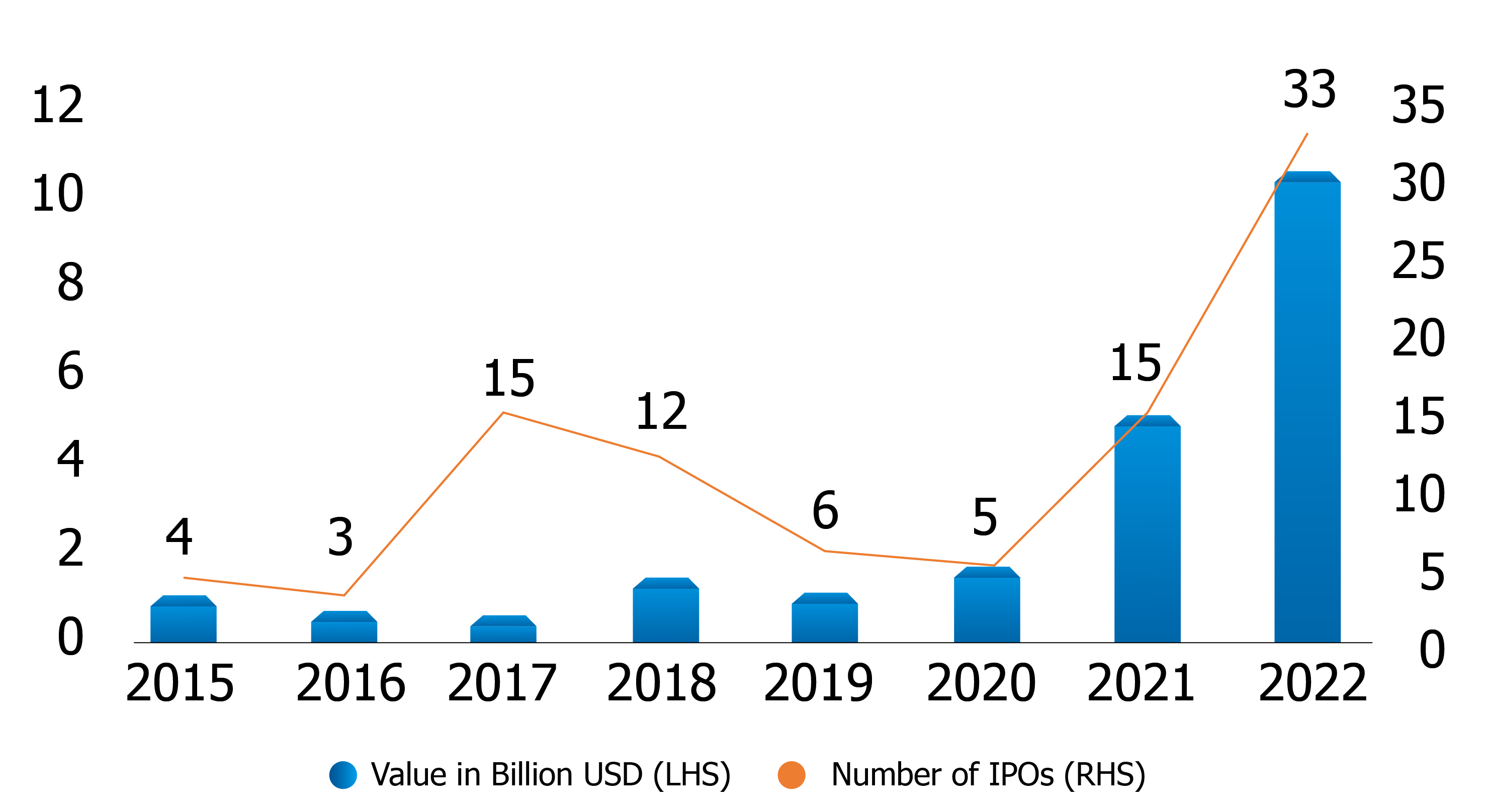

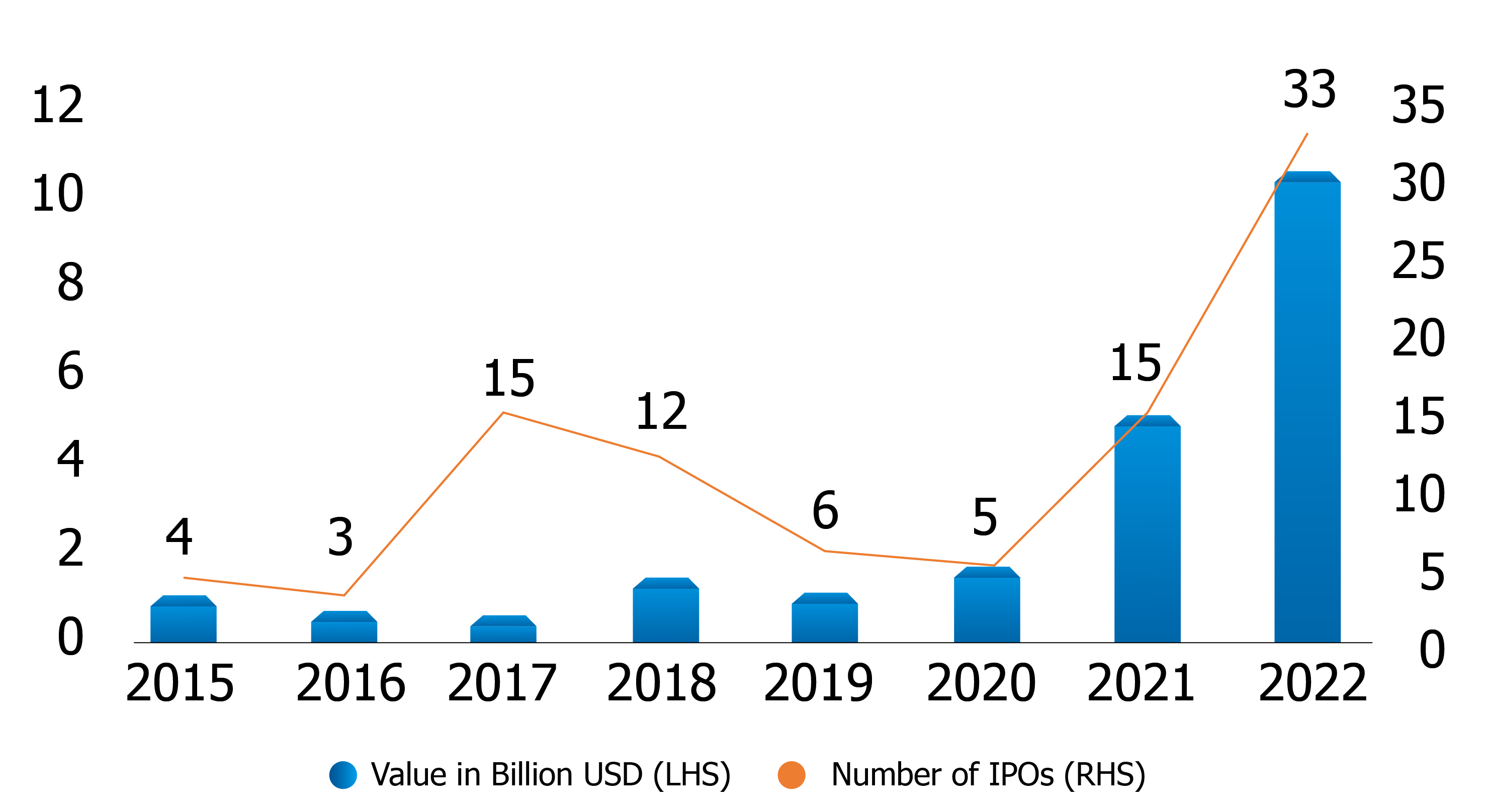

Supported by higher oil prices and the governments reform agenda in line with vision 2030 (unveiled in 2016), KSA’s IPO tally rose to 33 in 2022 as compared to 15 in 2021. KSA’s major listing following the dual listing of UAE based Americana, in 2022 was of pharmaceutical giant Nahdi Medical at USD 1.4 Billion. A total of 3,900,000 shares were allotted to the individual investors representing 10% of the total offering. The retail offering followed the completion of the institutional book-building process, which was oversubscribed 59 times. Nahdi Medical’s share rose 11% by the end of 2022 since its listing on 15th March.

Exhibit – KSA IPO activity since 2015

Supported by higher oil prices and the governments reform agenda in line with vision 2030 (unveiled in 2016), KSA’s IPO tally rose to 33 in 2022 as compared to 15 in 2021. KSA’s major listing following the dual listing of UAE based Americana, in 2022 was of pharmaceutical giant Nahdi Medical at USD 1.4 Billion. A total of 3,900,000 shares were allotted to the individual investors representing 10% of the total offering. The retail offering followed the completion of the institutional book-building process, which was oversubscribed 59 times. Nahdi Medical’s share rose 11% by the end of 2022 since its listing on 15th March.

Exhibit – KSA IPO activity since 2015

Source – PWC and Refinitiv

Another major listing was of Saudi Aramco Base Oil Company (Luberef) worth USD 1.3 Billion. The number of shares offered to individual investors was 12,511,250 representing 25% of the total offering shares. This was after the successful completion of the book building process that was oversubscribed by 29.5 times.

IPOs in UAE increased from 4 in 2021 to 9 in 2022. The listing of UAE’s state-owned entity Dubai Electricity And Water Authority (DEWA) worth USD 6 billion was the biggest equity market deal in the GCC, in 2022. The listing of DEWA is a part of the country’s plans to list 10 state-owned firms to boost the size of the Emirate's stock exchange to Dh3 trillion and to create a Dh2 billion market maker fund to encourage the listing of more private companies in industries like energy, logistics, and retail. Another highlight of UAE’s IPO listing in 2022 was the joint Abu Dhabi-Riyadh listing of food giant Americana worth USD 1.8 billion. The joint listing was the first of its kind in the Saudi and Abu Dhabi exchange. Americana’s decision to list its shares on both markets was to increase their access to capital and provide more liquidity. The UAE has further looked to strengthen IPO activity with initiatives such as The Thabat program. The program aims to transform 200 family business projects into major companies by 2030 with a market value exceeding USD40 Billion . This is done by supporting business ideas into viable projects, encouraging firms to do business outside their traditional fields and embrace advanced knowledge-driven industries such as artificial intelligence, biotechnology, agricultural technology, space sciences and renewable energy.

Oman’s IPO activity has been limited with 4 listings in the last 3 years. Oman and Bahrain are the only GCC countries not classified as emerging markets by MSCI Inc . The market capitalization of Oman’s stock exchange is about USD21 billion .. In September 2022, Oman’s Muscat Stock Exchange (MSX) teamed up with United Arab Emirates-based Al Ramz Corporation Investment and Development PJSC and Oman-based Ubhar Capital SAOC to formulate capital market opportunities. The MSX also joined a platform known as Tabadul that will enable companies listed on the Omani bourse to trade on the Abu Dhabi and Bahrain stock exchanges to boost liquidity.

Ali- Alghanim and Sons, a family-owned conglomerate, is Kuwait’s only listing in 2022.

Despite an inflow of USD 4 Billion in foreign investments and heightened economic activity due to the World Cup, Qatar has not had any listings in 2022. This could be due to companies awaiting peak performance of markets to raise equity at higher valuations and better listing support.

Conclusion

KSA and UAE dominated GCC IPOs in 2022, comprising 93.5% of the total listings by deal count. The other 4 GCC nations have had lesser listings despite strong potential. This can be attributed to relatively lesser reforms and programs offered by respective capital market authorities to support listings which are offered by KSA and UAE.

The uutlook for 2023 looks positive with Saudi Arabia looking to list its vast oil trading division Aramco Trading and the government working on issuing follow-on shares of Saudi Aramco. Abu Dhabi has shortlisted 6 private companies to receive investment and advisory services to list in its local bourse as a part of it USD 1.3 Billion fund launched in 2021 to support private companies. However, factors such as recession, rising interest rates and a decrease in demand for oil could threaten the market sentiment.

IPOs in UAE increased from 4 in 2021 to 9 in 2022. The listing of UAE’s state-owned entity Dubai Electricity And Water Authority (DEWA) worth USD 6 billion was the biggest equity market deal in the GCC, in 2022. The listing of DEWA is a part of the country’s plans to list 10 state-owned firms to boost the size of the Emirate's stock exchange to Dh3 trillion and to create a Dh2 billion market maker fund to encourage the listing of more private companies in industries like energy, logistics, and retail. Another highlight of UAE’s IPO listing in 2022 was the joint Abu Dhabi-Riyadh listing of food giant Americana worth USD 1.8 billion. The joint listing was the first of its kind in the Saudi and Abu Dhabi exchange. Americana’s decision to list its shares on both markets was to increase their access to capital and provide more liquidity. The UAE has further looked to strengthen IPO activity with initiatives such as The Thabat program. The program aims to transform 200 family business projects into major companies by 2030 with a market value exceeding USD40 Billion . This is done by supporting business ideas into viable projects, encouraging firms to do business outside their traditional fields and embrace advanced knowledge-driven industries such as artificial intelligence, biotechnology, agricultural technology, space sciences and renewable energy.

Oman’s IPO activity has been limited with 4 listings in the last 3 years. Oman and Bahrain are the only GCC countries not classified as emerging markets by MSCI Inc . The market capitalization of Oman’s stock exchange is about USD21 billion .. In September 2022, Oman’s Muscat Stock Exchange (MSX) teamed up with United Arab Emirates-based Al Ramz Corporation Investment and Development PJSC and Oman-based Ubhar Capital SAOC to formulate capital market opportunities. The MSX also joined a platform known as Tabadul that will enable companies listed on the Omani bourse to trade on the Abu Dhabi and Bahrain stock exchanges to boost liquidity.

Ali- Alghanim and Sons, a family-owned conglomerate, is Kuwait’s only listing in 2022.

Despite an inflow of USD 4 Billion in foreign investments and heightened economic activity due to the World Cup, Qatar has not had any listings in 2022. This could be due to companies awaiting peak performance of markets to raise equity at higher valuations and better listing support.

Conclusion

KSA and UAE dominated GCC IPOs in 2022, comprising 93.5% of the total listings by deal count. The other 4 GCC nations have had lesser listings despite strong potential. This can be attributed to relatively lesser reforms and programs offered by respective capital market authorities to support listings which are offered by KSA and UAE.

The uutlook for 2023 looks positive with Saudi Arabia looking to list its vast oil trading division Aramco Trading and the government working on issuing follow-on shares of Saudi Aramco. Abu Dhabi has shortlisted 6 private companies to receive investment and advisory services to list in its local bourse as a part of it USD 1.3 Billion fund launched in 2021 to support private companies. However, factors such as recession, rising interest rates and a decrease in demand for oil could threaten the market sentiment.