Kuwait Financial Centre “Markaz” recently rolled out its Monthly Market Research report containing an in-depth analysis, coupled with a critical examination, of the performance of equity markets in the MENA region and its global counterparts for the month of March 2017.

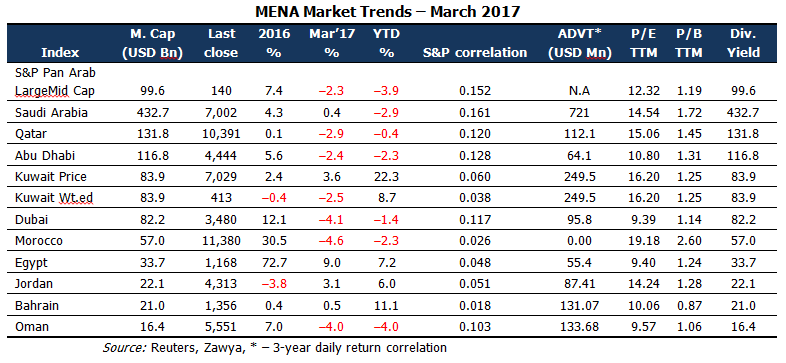

The report said that the majority of the MENA bourses continued to mirror their performance in March with that of February, falling flat to echo their positive start in January. Egypt and Kuwait price indices stood as exceptions, with their indices clinching a hike of 9 and 3.6%, respectively, at the end of the month. On the antithesis, the Morocco, Dubai and Oman indices steered to hit the reds, clocking a downtrend of 4.6%, 4.1% and 4.0%, respectively. To mark a mixed trend, the Saudi and Bahrain bourses failed to show any difference with respect to their performance in the previous month. The MENA markets, in trend with its global counterparts, continued on a slippery decline. Dubai witnessed bleaker trading volumes and dampened investor sentiments. Expectations of major events in the global arena for the month in concern, such as an expected hike in the FED interest rate and the outcome of the G20 meeting, restrained the investing sentiments of the traders. The index witnessed a steep downfall, attributable to the selling pressures in the Muscat stock exchange, especially in heavy-weight stocks such as Bank of Muscat. Thanks to the siphoning of foreign investments into the equities, the Egypt bourse managed to maintain a positive note with a 9% hike despite the bleaker market environment.

The month witnessed the volume traded hitting the reds with a negative growth of 22%, in contrast with a hike of 34.6% in the market turnover, indicating a mixed market mood. All MENA markets witnessed an increased turnover in March, leaving behind Saudi Arabia and Dubai to battle a negative market environment. Dubai and Abu Dhabi hit the lows in liquidity, with volumes spiraling down by 41 and 40%, respectively. Drawing the limelight on valuation, the market witnessed the P/E of Morocco (19.18), Kuwait (16.2) and Qatar (15.06) markets to be at premium, while their counterparts in Dubai (9.39), Egypt (9.4) and Bahrain (10.06) to be the discount markets in the MENA region.Blue Chips ended the month on a negative note, with most companies drenched in reds. Shares of Masraf Al Rayan hit the highs, touching down at an impressive 5.1%, the highest among the Blue Chips in GCC, with Ezdan Holdings (3.8%) seconding. Foreign institutional investors roped in fresh money into some Qatari companies while they withdrew from a few in the telecom sector. Fresh investments geared the share prices to clock a hike in Masraf Al Rayan. Ezdan holdings has also blared the roll out of its USD 2 Bn sukuk. The Saudi Telecom Company (STC) nailed five memorandums of understanding (MoUs) for 5G technology with its various compeers on the sidelines of the Mobile World Congress (MWC). It also banded with Oberthur Technologies to fathom the feasibility of eSIM technology that promises users to order, install and activate profiles over the air in a seamless and secure way. Projects and international collaborations announced by STC, the telecom operator tycoon in the MENA region, tipped its share price toward a 1.9% positive growth. The Qatari stocks, Ooredoo Qatar and Industries Qatar, were the laggards among the Blue Chips, shedding 8.9 and 7.7%, respectively. Selling of telecom, insurance and industrials by foreign institutional investors, coupled with the subsequent bullishness of the Qatari and GCC investors, marshaled the share prices down.

Kuwait International Bond Issuance

Kuwait has coffered USD 8 Bn through a dual tranche offering of 5- and 10-year notes and has launched a USD 3.5-Bn March 2022 bond at 75bp over Treasuries and a USD 4.5-Bn March 2027 note at plus 100bp. The absence of activity in the past shepherded the bond to being oversubscribed 3.2 times, with bids worth USD 29 Bn received, indicating hawkish investor sentiments toward debt markets. The current transaction surfaces up the fact that Kuwait holds the potential to source funds from the international debt markets in the times ahead, lead to domestic companies following suit and view foreign debt as a source of funding. The inclusion of international debt would make it easy for investors and analysts to estimate the risks of investing in the gulf state and and the same time make it easier for financial services firm to benchmark their products.

The final investor-type apportion for the 5-year bonds was as follows: 22% to banks and private banks; 60% to asset managers and 18% to agencies, pensions and insurance, while the final investor-type allocation for the 10-year bonds was 25% to banks and private banks; 68% to asset managers and 7% to agencies, pensions and insurance.

Oil Market Review

March 2017 witnessed the largest dip since July 2016 when Brent crude hit the all-time lows by clocking a slippery decline of 5%, touching down at USD 52.83. Poor commitment from the non-OPEC members to cut production was one of the reasons for the fall in oil prices. An initial jack up in oil prices at the start of the year opened the taps from rigs in the United States, thereby gearing up supply to the market and derailing the reduced production from the OPEC members.