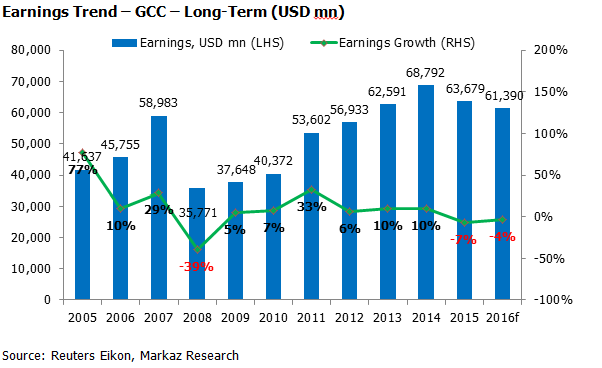

Persisting lower Oil prices, liquidity squeeze and sedate global growth led to decline in GCC corporate earnings during the first half period of 2016, compared with the corresponding period a year back. During the first half of 2016 (1H16), corporate earnings in the GCC fell by 8% over the same period in 2015. With the exception of Oman, which registered a growth of 7%, all other countries recorded negative growth.

Total earnings in 1H16 came in at USD 32.8 billion, partly supported by telecom and financial services sector. Among sectors, telecommunications and financial services posted positive earnings growth, as contribution from international markets and favorable exchange movements supported their bottom line. Earnings in banking sector remained flat while earnings in commodities, real estate and construction related sectors contracted as the fall in oil prices is increasingly felt across non-oil sectors.

Blue chips fared relatively better, while earnings of mid-cap and small-cap companies took a beating in H1 2016, falling by 38% (YoY) and 22% (YoY), respectively. Earnings for large cap stocks (market cap > USD 3bn; 60 companies, 73% of all GCC market cap) declined by 5% in 1H16. For the full year of 2016, we estimate earnings to fall by 4%.

Saudi Arabia

Saudi Arabia witnessed a decline of 7% in net earnings in H1 2016, compared with the same period a year back. Earnings declined for all sectors except financial services. The highest decline in earnings were witnessed in the real estate (-50%) and conglomerate (-36%) sectors. We estimate full year earnings to fall by 6% in 2016, due to further fall in earnings in the commodities, banking and construction-related sectors, as growth is expected to be affected by depressed oil prices.

Kuwait

Kuwait witnessed a decline of 6% in net earnings in H1 2016, with commodities, real estate and financial services declining by 11%, 23% and 53% respectively. Banking and telecom sectors were the only exceptions in Kuwait as their earnings bucked the declining trend. For 2016 full year, Kuwaiti corporate earnings are expected to fall by 2%, due to moderate growth in banking and telecom sector.

UAE

Earnings for UAE companies witnessed a decrease of 8% in H1 2016 (YoY basis) owing to low oil prices, sluggish economy and poor performance of real estate companies. Real Estate sector as a whole declined by 4% during H1 2016 as real estate prices in the UAE were down owing to poor business sentiments and stagnant sales. We expect UAE corporate earnings to fall by 3%, as subdued credit growth is expected to take a toll on banking sector earnings in H2 2016 and on expectations of further earnings contraction in real estate sector.

Qatar

Qatar earnings fell by 11% in H1 2016. Qatar’s net earnings growth was affected by the fall in real estate sector earnings which fell by close to 50%. Telecommunications and banking sectors witnessed an increase in earnings during H1 2016 at 35% and 3%, respectively. We expect full earnings to be flat for Qatar in 2016 due to continued thrust on infrastructure developments and relatively better credit growth expectations than its GCC peers.

About Kuwait Financial Centre “Markaz”

Kuwait Financial Centre K.P.S.C “Markaz”, with total assets under management of over KD 943 million as of June 30,2016 (USD 3.12 billion), was established in 1974 and has become one of the leading asset management and investment banking institutions in the Arabian Gulf Region. Markaz was listed on the Kuwait Stock Exchange (KSE) in 1997.

For further information, please contact:

Alrazi AlBudaiwi

Assistant Vice President

Media & Communications Department

Kuwait Financial Centre K.P.S.C "Markaz"

Tel: +965 2224 8000 ext 1800

Fax: +965 2241 4499

Email: [email protected]

www.markaz.com