_36.jpg)

Kuwait Financial Centre “Markaz” recently released its Monthly Market Research report. In this report, Markaz examines and analyzes the performance of equity markets in the MENA region as well as the global equity markets for the month of August.

The report stated that Kuwait’s price index ended the month of August with a loss of 6.9%, while the weighted index declined by 8%. Brent crude fell 18% in August, before recovering in the last week of the month, and closing the month at USD 54.15/bbl, a 3.7% rise. The last minute surge was fueled by an OPEC commentary indicating that the cartel was willing to talk to other producers to achieve fair oil prices, as well as by a downward revision of US output. EIA estimates that US daily production has fallen by 0.1m barrels, while the number of rigs drilling for oil in the US has fallen 58% since October.

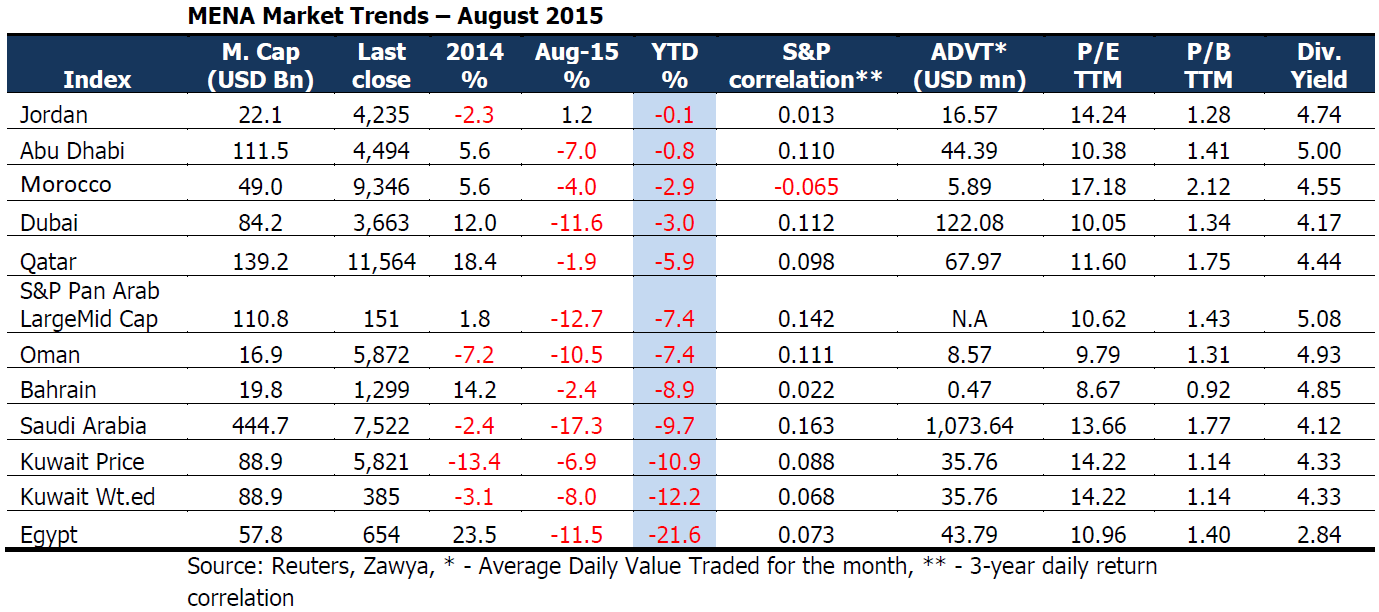

The report added that MENA markets ended in red during the month of August 2015. Saudi Arabia (-17.3%) suffered the most, followed by Dubai (-11.6%), Egypt (-11.5%) and Oman (-10.5%). The August decline in the MENA wiped out all gains made by the stock markets since the beginning of the year, with all of the indices now dipping into the red. Amman index (1.2%) was the only market that ended the month in the green.Sell-off in Chinese equities combined with the fall in oil prices were the reason behind the overall fall in stock markets in the region. In August, China's manufacturing activity had contracted at its fastest pace in three years, reinforcing fears of a slowdown in the world's second-largest economy despite a flurry of government support measures. The Chinese manufacturing purchasing managers’ index (PMI) fell to a three-year low of 49.7 last month, down from 50 in July, implying a contraction. Tadawul index was the second worst performing in the world in August, after the Athens index, following the slump in oil price, which accounts for nearly 90% of the country’s revenue . Unclear fiscal policy, continuing fall in oil prices, and outlook downgrade by Fitch ratings from “stable” to “negative” contributed to the negative sentiment among investors.

MENA markets liquidity rose in August, with volume increasing 50% and value traded rising 56.4%, as the market activity improved after the lull in July, due to Ramadan. The notable exceptions to this trend were seen in Abu Dhabi and Morocco. Abu Dhabi’s total value traded decreased by 34% and the volume traded decreased by 7%, while Morocco’s value traded decreased by 17%, and volume traded decreased by 36%.

Ezdan Holdings (Qatar) had the only positive return (8.2%) among the blue chip stocks during the month of August, after MSCI indicated that it would raise the weightings for the stock in the Emerging Markets index by the end of August. The worst performing stocks were Kuwait Food (-24.1%), Al-Rajhi Bank (-17.6%), and Saudi Basic (-16.5%). Kuwait Food Co. (Americana) released its Q2 results in August, and the company declared a slump in profit of 46% due to slower sales during the Muslim month of fasting and higher operating costs. SABIC, meanwhile, continues to be affected by the fall in oil prices.

Chinese sell off – Black Monday

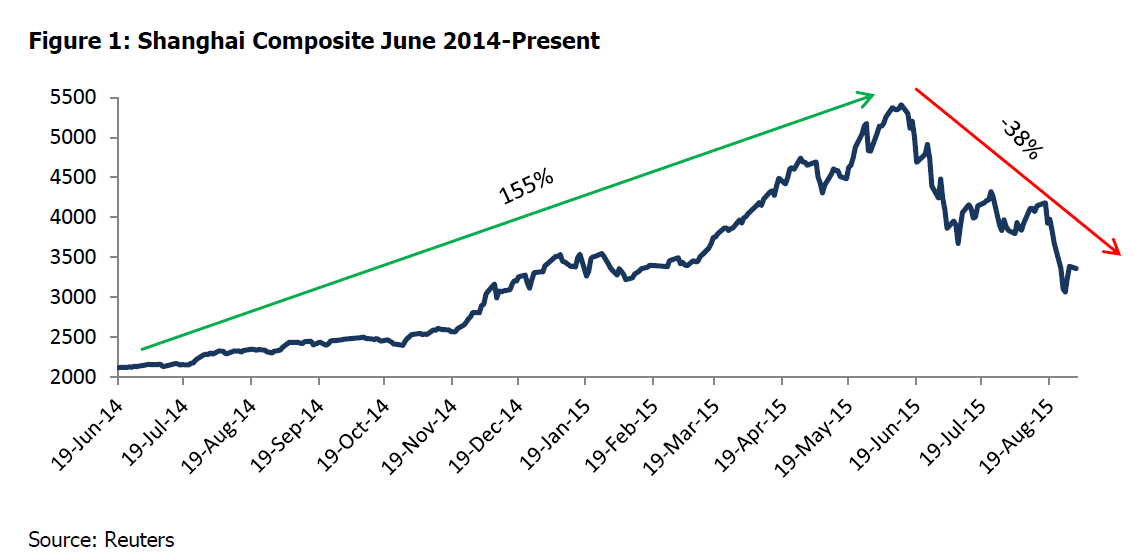

Global equities have sold off in recent days on growing concerns that a slowdown in China will trigger a global recession. China has emerged as a significant driver of global economic growth, and accounts for almost half of the world growth and 15% of global economic output. Chinese economy is in transition, shifting from an export-led growth model to domestic consumption driven economy. Slowdown in Chinese economy seems to have had significant global repercussion, with markets across the world falling in response to Chinese equities sell-off. Attempts to manage the economic slowdown (Easing rates by PBOC, Yuvan devaluation etc.) have not borne fruit. Although there is no significant economic impact on developed economies, the developed markets fell due to negative sentiment surrounding global policy makers. The impact will be most felt on EM and GCC, which export commodities to China. China consumes 57% of World’s copper and imports 2/3rds of world’s Iron ore.

Shares in China had soared 155% in the 12 months leading up to June 2015, as individual investors borrowed heavily to invest into a bull market. But all of this came to a standstill, as the index hit a seven-year peak in June 2015, with signs of economic slowdown, decline in manufacturing activity, and an overvalued market. On the 24th Aug 2015, now dubbed “Black Monday”, China’s stock markets lost all their gains for the year, intensifying worries about the world’s second-largest economy, leading to commodities such as crude oil and copper tumbling to multi-year lows.

###

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the Arabian Gulf Region with total assets under management of over KD 1.10 billion as of June 30th, 2015. Markaz was listed on the Kuwait Stock Exchange (KSE) in 1997.

For further information, please contact:

Osama Al MusallamSenior Communications Officer

Media & Communications Department

Kuwait Financial Centre S.A.K. "Markaz"

Tel: +965 2224 8000 ext 1819

Dir: +965 2224 8075

Fax: +965 2241 4499

Email: [email protected]

www.markaz.com